Management's Discussion & Analysis

Introduction

The Fiscal Year 2019 Financial Report provides the President, Congress, and the American people with a comprehensive view of the federal government’s financial position and condition and discusses important financial issues and significant conditions that may affect future operations, including the need to achieve fiscal sustainability over the medium and long term.

Pursuant to 31 U.S.C. § 331(e)(1), the Treasury, in cooperation with OMB, must submit an audited (by GAO) financial statement for the preceding fiscal year, covering all accounts and associated activities of the executive branch of the U.S. government1 to the President and Congress no later than six months after the September 30 fiscal year-end.

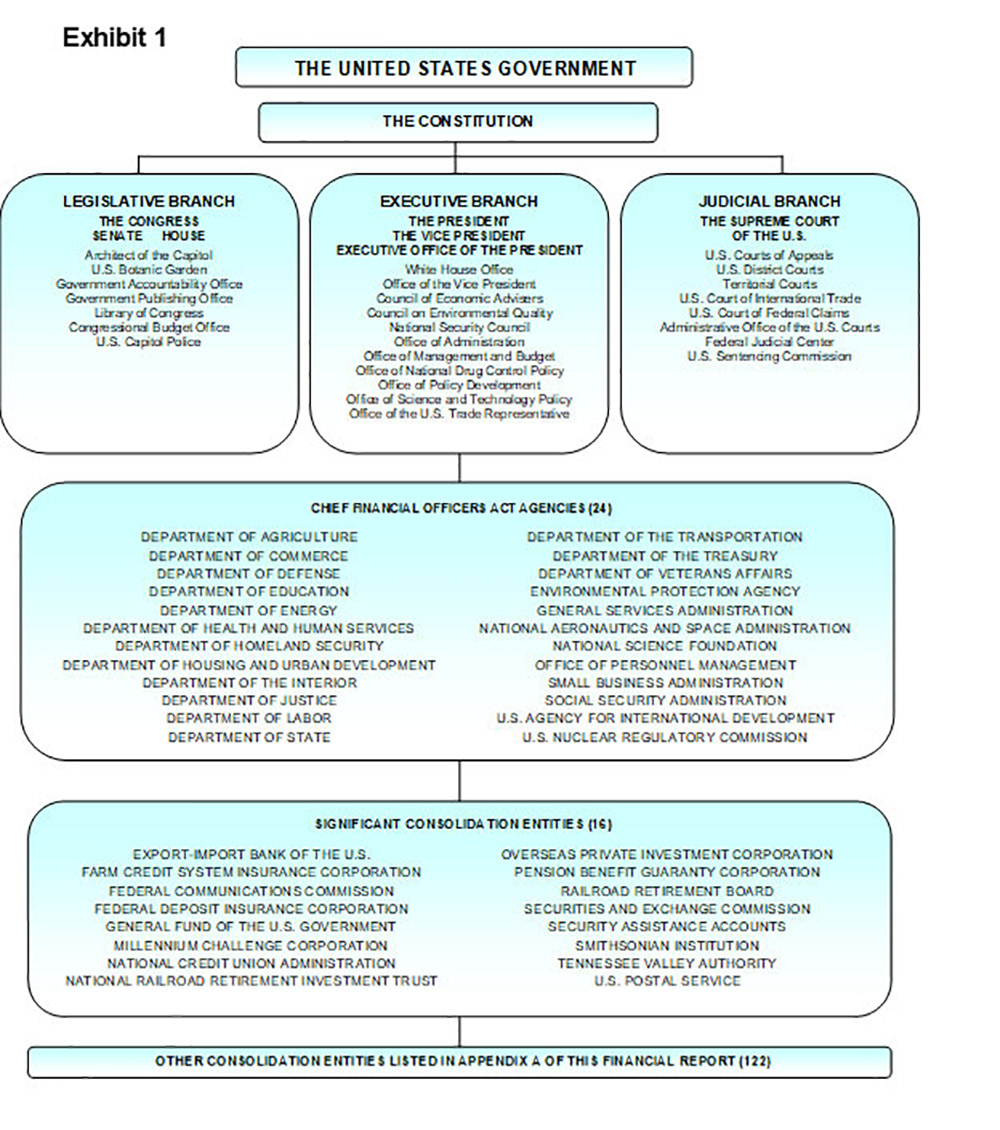

The Financial Report is prepared from the financial information provided by 162 federal consolidation entities (see organizational chart on the next page and Appendix A). As it has for the past 22 years, GAO issued a disclaimer of opinion on the accrual-based, consolidated financial statements for the fiscal years ended September 30, 2019 and 2018. GAO also issued a disclaimer of opinion on the sustainability financial statements, which consist of the 2019 and 2018 SLTFP; the 2019, 2018, 2017, 2016, and 2015 SOSI; and the 2019 and 2018 SCSIA. A disclaimer of opinion indicates that sufficient information was not available for the auditors to determine whether the reported financial statements were fairly presented in accordance with GAAP. In fiscal year 2019, 352 of the 40 most significant entities earned unmodified (“clean”) opinions on their financial statements.

The fiscal year 2019 Financial Report consists of:

- MD&A, which provides management’s perspectives on and analysis of information presented in the Financial Report, such as financial and performance trends;

- Financial statements and the related notes to the financial statements;

- RSI, RSSI, and Other Information; and

- GAO’s audit report.

This Financial Report addresses the government’s financial activity and results as of and for the fiscal years ended September 30, 2019 and 2018. Note 27, Subsequent Events discusses events that occurred after the end of the fiscal year that may affect the government’s financial position and condition.

In addition, the Results in Brief and Executive Summary to this Financial Report provides a quick reference to the key issues in the Financial Report and an overview of the government's financial position and condition.

Mission & Organization

The government’s fundamental mission is derived from the Constitution: “…to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare and secure the blessings of liberty to ourselves and our posterity.” The government’s functions have evolved over time to include health care, income security, veterans benefits and services, housing and transportation, security, and education. Exhibit 1 provides an overview of how the U.S. government is organized.

Notes

1 The Government Management Reform Act of 1994 has required such reporting, covering the executive branch of the government, beginning with financial statements prepared for FY 1997. The consolidated financial statements include the legislative and judicial branches. (Back to Content)

2 The 35 entities include the Department of Health and Human Services, which received disclaimers of opinion on its 2019, 2018, 2017, 2016, and 2015 SOSI and on its 2019 and 2018 SCSIA. (Back to Content)

- A Message from the Secretary of the Treasury - PDF version

- Table of Contents - PDF version

- Results in Brief - PDF version

- The Nation By The Numbers

- Executive Summary - PDF version

- Management's Discussion & Analysis - PDF version

- Statement of the Comptroller General of the United States - PDF version

- Financial Statements- PDF version

- Statements of Net Cost

- Statements of Operations and Changes in Net Position

- Reconciliations of Net Operating Cost and Budget Deficit

- Statements of Changes in Cash Balance from Budget and Other Activities

- Balance Sheets

- Statements of Long-Term Fiscal Projections

- Statements of Social Insurance and Changes in Social Insurance Amounts

- Statements of Changes in Social Insurance Amounts

- Notes to the Financial Statements - PDF version

- Note 1. Summary of Significant Accounting Policies - PDF version

- Note 2. Cash and Other Monetary Assets - PDF version

- Note 3. Accounts and Taxes Receivable, Net - PDF version

- Note 4. Loan Receivable and Loan Guarantee Liabilities, Net - PDF version

- Note 5. Inventories and Related Property, Net - PDF version

- Note 6. Property, Plant, and Equipment, Net - PDF version

- Note 7. Debt and Equity Securities - PDF version

- Note 8. Investments in Government-Sponsored Enterprises - PDF version

- Note 9. Other Assets - PDF version

- Note 10. Accounts Payable - PDF version

- Note 11. Federal Debt Securities Held by the Public and Accrued Interest - PDF version

- Note 12. Federal Employee and Veteran Benefits Payable - PDF version

- Note 13. Environmental and Disposal Liabilities - PDF version

- Note 14. Benefits Due and Payable - PDF version

- Note 15. Insurance and Guarantee Program Liabilities - PDF version

- Note 16. Other Liabilities - PDF version

- Note 17. Collections and Refunds of Federal Revenue - PDF version

- Note 18. Contingencies - PDF version

- Note 19. Commitments - PDF version

- Note 20. Funds from Dedicated Collections - PDF version

- Note 21. Fiduciary Activities - PDF version

- Note 22. Social Insurance - PDF version

- Note 23. Long-Term Fiscal Projections - PDF version

- Note 24. Stewardship Land and Heritage Assets - PDF version

- Note 25. Disclosure Entities and Related Parties - PDF version

- Note 26. Public-Private Partnerships - PDF version

- Note 27. Subsequent Events - PDF version

- Required Supplementary Information (Unaudited) - PDF version

- The Sustainability of Fiscal Policy - PDF version

- Social Insurance - PDF version

- Deferred Maintenance and Repairs - PDF version

- Other Claims for Refunds - PDF version

- Tax Assessments - PDF version

- Federal Oil and Gas Resources - PDF version

- Federal Natural Resources Other than Oil and Gas - PDF version

- Other Information (Unaudited) - PDF version

- Tax Burden - PDF version

- Tax Gap - PDF version

- Tax Expenditures - PDF version

- Unmatched Transactions and Balances - PDF version

- Required Supplementary Stewardship Information (Unaudited) - PDF version

- Appendices

- Appendix A: Reporting Entity - PDF version

- Appendix B: Acronyms - PDF version

- U.S. Government Accountability Office Independent Auditor's Report - PDF version

- Related Resources

Certain material weaknesses, limitations, and uncertainties prevented the Government Accountability Office from expressing an opinion on the U.S. Government's consolidated financial statements included in the Financial Report and, therefore, GAO disclaimed an opinion on such statements. Certain information included on or referenced in this website, such as individual agency financial reports that were audited by other auditors, is separate from and not specifically reported in the Financial Report and therefore not covered by GAO's disclaimer.