If You Want To...

The information below will help answer your questions about payments from federal agencies. In most cases, you will need to contact the agency that issued the payment. You can find agency contact information at https://www.usa.gov/agency-index.

For Individuals

Contact the paying agency and report the incident. If you need contact information for the paying agency, go to https://www.usa.gov/agency-index. The agency will help you with the claims process. You will be sent information on the check claims process, including forms you must return for processing.

If you need help filling out the forms, watch one of the following videos:

Go to www.irs.gov and click on the Where’s My Refund tool. You may also contact the IRS directly at 1-800-829-1040

NOTE: If you have received a payment from the Social Security Administration that you didn’t expect, please see https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html since you may have benefitted from the Fairness Act. If you have further questions about the payment, please contact Social Security at 1-800-772-1213.

If you received a check or Electronic Funds Transfer (EFT) payment from Treasury and don't know why it was sent to you, find the agency that sent you the payment by using the EFT and Check agency identification tips below.

EFT Payment Identification Tips

To find the agency responsible for a payment deposited directly into your bank account, you can get the payment details from your bank account statement and use the information below to identify the paying agency and payment type. If needed, you can then contact the agency using the contact information at https://www.usa.gov/agency-index.

| Paying Agency / Payment Type | Payment Details on Your Account Statement |

|---|---|

| Fiscal Service/TreasuryDirect Marketable Securities / Savings Bonds Government Series Security Payments |

‘~~MISC PAY' ‘~~PAY' ‘~~SLG_PMT ‘ |

| Internal Revenue Service (IRS) Internal Revenue Service – Tax Refund Internal Revenue Service (Economic Impact Payment Internal Revenue Service (Advance Child Tax Credit) |

‘~~TAX REF ‘ ‘~~TAXEIP#_’ (# = 1, 2, or 3) ‘~~CHILDCTC’ |

| Department of Veterans Affairs (VA) Compensation and Pension Insurance Education |

‘XXVA_BENEF’ ‘XXVA INSUR’ ‘XXVA _ _ _ _ _ _’ (Various values like ‘EDUC’, ‘CH35’, ‘1607’, and the like) |

| Federal Pay - (Contact your government employer if you have questions about the payment.) Federal Salary Federal Travel Payments Federal Annuity Federal Vendor/Misc |

‘~~FED SAL ‘ ‘~~FED TVL' ‘~~FED ANNU’ ‘~~MISC PAY’ |

| Office of Personnel Management (OPM) Civil Service Retirement (Annuity) |

‘XXCIV SERV’ |

| Railroad Retirement Board (RRB) Railroad Retirement/Annuity Unemployment/Sickness |

‘XXRR RET ‘ ‘XXRR UISI ‘ |

| Social Security Administration (SSA) Social Security Supplemental Security Income |

‘XXSOC SEC ‘ ’XXSUPP SEC’ |

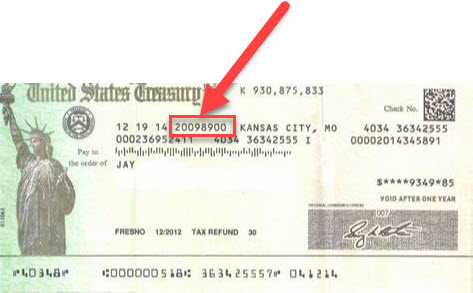

Check Payment Identification Tips

If you received a check, determine the paying agency by finding the Agency Location Code (ALC) on the check and using the guide below. You can then contact the agency using the contact information at https://www.usa.gov/agency-index.

| ALC | Agency |

|---|---|

| 02700518 | Federal Communications Commission |

| 05000001 | US Government Accountability Office (GAO) |

| 12XXXXXX | Department of Agriculture |

| 13XXXXXX | Department of Commerce |

| ALCs starting with 16XXXXXX |

Department of Labor |

| ALCs starting with 2009XXXX |

Internal Revenue Service (IRS) |

| ALCs starting with 24XXXXXX |

Office of Personnel Management (OPM) |

| ALCs starting with 2804XXXX |

Social Security Administration (SSA) |

| 33010001 | Smithsonian Institution (SI) |

| 36001200 | Department of Veterans Affairs (VA) |

| 36000201 | Department of Veterans Affairs (VA) |

| 36000201 | Department of Veterans Affairs (VA) Education Benefits |

| 36000310 | Department of Veterans Affairs (VA) Insurance |

| 47000016 | General Services Administration (GSA) |

| 47000017 | General Services Administration-USDA |

| 60009301 | Railroad Retirement Board (RRB) |

| 73000001 | Small Business Administration (SBA) |

| 75XXXXXX | Department of Health and Human Services |

| 91XXXXXX | Department of Education |

| 95550001 | Corporation for National and Community Service |

If you can’t find the agency, the Bureau of the Fiscal Service Call Center can help. The Bureau of the Fiscal Service Call Center can be reached by calling 1-855-868-0151 or e-mailing PFC.CustomerEngagementCenter@fiscal.treasury.gov

If you wish to report the death of an individual, please contact the paying agency.

Visit https://www.fiscal.treasury.gov/foia.html for FOIA requests or e-mail CongressionalInquiries@fiscal.treasury.gov for Congressional inquiries.

If you have an expired Treasury check, you must contact the federal agency which authorized issuance of the check payment. They will be able to reissue your check. If you need help identifying which federal agency issued the payment, you can use the information on the check to identify the .

Fiscal Service is unable to make any changes in your payment information. To update the personal information associated with a federal payment – including your name, address, bank account, and so on – you will need to contact the federal agency that pays you. Agencies maintain payment records and can update them at your direction. To avoid any possible delays in getting your payments, notify the paying agency immediately following any changes.

GoDirect

Are you still receiving Social Security, VA benefits, or other federal benefits by paper check? If so, you are out of compliance with the law. The U.S. Department of the Treasury requires federal benefit payments to be made electronically – through direct deposit to a bank or credit union account or to the Direct Express® Debit Mastercard®. Enrolling is fast and easy. It’s safer, more secure, and more convenient than getting your payment by check. You must have a bank account to get your payments by direct deposit. Your money will be in your account on time, every time. For help with setting up Direct Deposit for a federal benefit payment, visit GoDirect at https://godirect.gov/ or call one of the following numbers:

- 1-800-333-1795 (English)

- 1-800-333-1792 (Español)

Direct Deposit from an Agency

To receive payments from a specific agency by direct deposit, you will need to contact the government agency that pays you. If you need contact information for the paying agency, go to https://www.usa.gov/agency-index. For most agencies, the first step is to fill out the direct deposit enrollment form. Be sure to verify with your bank the routing and account number information that is required. Return the completed form to the paying agency or to your bank.

International Direct Deposit

If you receive Federal benefits, and you live or bank outside the United States, you may still be able to receive your payments by direct deposit. Please contact the federal agency that issues you a payment or benefit for specific instruction. Key benefit issuing agency contact information is listed below under Other Helpful Links.

Also, you can visit GoDirect at https://godirect.gov/gpw/enroll-by-mail/ and scroll down to “International” to learn about enrolling by mail.

Please contact the federal agency that authorized your payment at the numbers listed below:

- Social Security Administration

- SSA Website

1-800-772-1213 - Internal Revenue Service (IRS)

- IRS Website

1-800-829-1040 - Department of Veterans Affairs

- VA Website

1-800-827-1000 - Office of Personnel Management

- OPM Website

1-888-767-6738 - Railroad Retirement Board

- RRB Website

1-877-772-5772 - Defense Finance and Accounting Service

- Used for all Department of Defense payments

DFAS Website

For Federal Program Agencies, Financial Institutions, and Others

If you are with a federal agency, Office of Inspector General, or Law Enforcement group investigating a legal matter about federal payments, contact FDS.customersupport@fiscal.treasury.gov or paymentintegrity@fiscal.treasury.gov.

If you represent a federal program agency or financial institution and have questions or need help with a payment issue where fraud is suspected, please call 1-855-868-0151 or e-mail PFC.CustomerEngagementCenter@fiscal.treasury.gov.

If you are a representative of a federal agency and wish to reclaim payments mistakenly sent after the payee’s death, submit a claim in Treasury Check Information System (TCIS) for that payment or follow your agency’s claim process.

Visit https://www.fiscal.treasury.gov/foia.html for FOIA requests.

To submit a Congressional inquiry, e-mail CongressionalInquiries@fiscal.treasury.gov.