Management's Discussion & Analysis

Introduction

The Fiscal Year (FY) 2017 Financial Report of the United States Government (Financial Report) provides the President, Congress, and the American people with a comprehensive view of the federal government’s financial position and condition, and discusses important financial issues and significant conditions that may affect future operations, including the need to achieve fiscal sustainability over the medium and long term.

Pursuant to 31 U.S.C. § 331(e)(1), the Department of the Treasury (Treasury), in cooperation with the Office of Management and Budget (OMB), must submit an audited (by the Government Accountability Office or GAO) financial statement for the preceding fiscal year, covering all accounts and associated activities of the executive branch of the United States Government1 to the President and Congress no later than six months after the September 30 fiscal year-end.

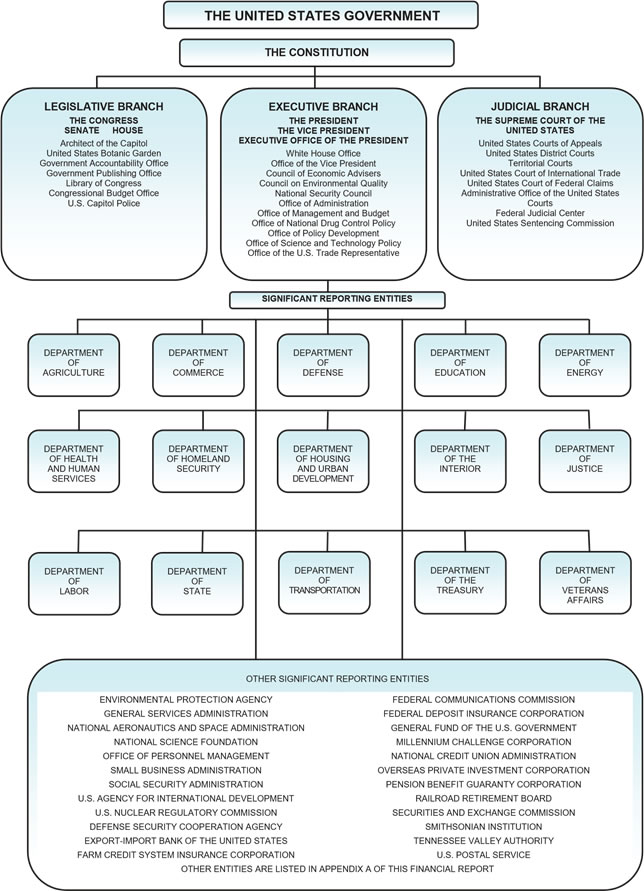

The Financial Report is prepared from the audited financial statements of specifically designated federal agencies, (see organizational chart on the next page and Appendix A). As it has for the past twenty years, GAO issued a disclaimer of opinion on the accrual-based, consolidated financial statements for the fiscal years ended September 30, 2017 and 2016. GAO also issued a disclaimer of opinion on the sustainability financial statements, which consist of the 2017 and 2016 Statements of Long-Term Fiscal Projections (SLTFP); the 2017, 2016, 2015, 2014, and 2013 Statements of Social Insurance (SOSI); and the 2017 and 2016 Statements of Changes in Social Insurance Amounts (SCSIA). A disclaimer of opinion indicates that sufficient information was not available for the auditors to determine whether the reported financial statements were fairly presented in accordance with Generally Accepted Accounting Principles (GAAP). In FY 2017, 332 of the 39 most significant agencies earned unmodified opinions on their financial statement audits. The FY 2017 Financial Report consists of:

- Management’s Discussion and Analysis (MD&A), which provides management’s perspectives on and analysis of information presented in the Financial Report, such as financial and performance trends;

- Principal financial statements and the related notes to the financial statements;

- Required Supplementary Information (RSI), Required Supplementary Stewardship Information (RSSI), and Other Information; and

- GAO’s audit report.

This Financial Report addresses the Government’s financial activity and results as of September 30, 2017. Note 25, Subsequent Events discusses events that occurred after the end of the fiscal year which may affect the Government’s financial position and condition.

In addition, the Executive Summary to this Financial Report provides a quick reference to the key issues in the Financial Report and an overview of the Government's financial position and condition.

Mission & Organization

The Government's fundamental mission is derived from the Constitution: "…to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare and secure the blessings of liberty to ourselves and our posterity." The Government’s functions have evolved over time to include health care, income security, veterans benefits and services, housing and transportation, security, and education. Exhibit 1 provides an overview of how the U.S. Government (Government) is organized.

Notes

1 The Government Management Reform Act of 1994 has required such reporting, covering the executive branch of the Government, beginning with financial statements prepared for FY 1997. Treasury and OMB included the legislative and judicial branches in the consolidated financial statements as well. (Back to Content)

2 The 33 agencies include: (1) the Department of Health and Human Services, which received disclaimers of opinion on its 2017, 2016, 2015, 2014, and 2013 SOSI and on its 2017 and 2016 SCSIA; (2) the Department of Labor, which received disclaimers of opinion on its 2017 SCSIA and 2016 SOSI and SCSIA; and (3) the Department of Agriculture (USDA), which received an unmodified opinion only on its balance sheet (other statements were not audited). The Department of Energy (DOE) expects to issue its audited Agency Financial Report (AFR) after the release of this Financial Report. (Back to Content)

- A Message from the Secretary of the Treasury - PDF version

- Table of Contents - PDF version

- Results in Brief - PDF version

- The Nation By The Numbers

- Executive Summary - PDF version

- Management's Discussion & Analysis - PDF version

- Statement of the Comptroller General of the United States - PDF version

- Financial Statements - PDF version

- Statements of Net Cost

- Statements of Operations and Changes in Net Position

- Reconciliations of Net Operating Cost and Budget Deficit

- Statements of Changes in Cash Balance from Budget and Other Activities

- Balance Sheets

- Statements of Long-Term Fiscal Projections

- Statements of Social Insurance and Changes in Social Insurance Amounts

- Statements of Changes in Social Insurance Amounts

- Notes to the Financial Statements - PDF version

- Note 1. Summary of Significant Accounting Policies - PDF version

- Note 2. Cash and Other Monetary Assets - PDF version

- Note 3. Accounts and Taxes Receivable, Net - PDF version

- Note 4. Loan Receivable and Loan Guarantee Liabilities, Net - PDF version

- Note 5. Inventories and Related Property, Net - PDF version

- Note 6. Property, Plant, and Equipment, Net - PDF version

- Note 7. Debt and Equity Securities - PDF version

- Note 8. Investments in Government-Sponsored Enterprises - PDF version

- Note 9. Other Assets - PDF version

- Note 10. Accounts Payable - PDF version

- Note 11. Federal Debt Securities Held by the Public and Accrued Interest - PDF version

- Note 12. Federal Employee and Veteran Benefits Payable - PDF version

- Note 13. Environmental and Disposal Liabilities - PDF version

- Note 14. Benefits Due and Payable - PDF version

- Note 15. Insurance and Guarantee Program Liabilities - PDF version

- Note 16. Other Liabilities - PDF version

- Note 17. Collections and Refunds of Federal Revenue - PDF version

- Note 18. Contingencies - PDF version

- Note 19. Commitments - PDF version

- Note 20. Funds from Dedicated Collections - PDF version

- Note 21. Fiduciary Activities - PDF version

- Note 22. Social Insurance - PDF version

- Note 23. Long-Term Fiscal Projections - PDF version

- Note 24. Stewardship Land and Heritage Assets - PDF version

- Note 25. Subsequent Events - PDF version

- Required Supplementary Information (Unaudited) - PDF version

- The Sustainability of Fiscal Policy - PDF version

- Social Insurance - PDF version

- Deferred Maintenance and Repairs - PDF version

- Other Claims for Refunds - PDF version

- Tax Assessments - PDF version

- Federal Oil and Gas Resources - PDF version

- Federal Natural Resources Other than Oil and Gas - PDF version

- Other Information (Unaudited) - PDF version

- Tax Burden - PDF version

- Tax Gap - PDF version

- Unmatched Transactions and Balances - PDF version

- Required Supplementary Stewardship Information (Unaudited) - PDF version

- Appendices

- Appendix A: Reporting Entity - PDF version

- Appendix B: Acronyms - PDF version

- U.S. Government Accountability Office Independent Auditor's Report - PDF version

- List of Social Insurance Charts - PDF version

- Related Resources

Certain material weaknesses, limitations, and uncertainties prevented the Government Accountability Office from expressing an opinion on the U.S. Government's consolidated financial statements included in the Financial Report and, therefore, GAO disclaimed an opinion on such statements. Certain information included on or referenced in this website, such as individual agency financial reports that were audited by other auditors, is separate from and not specifically reported in the Financial Report and therefore not covered by GAO's disclaimer.