Fiscal Service Makes Progress to Reduce Paper Checks

Treasury’s Fiscal Service Shares Progress on the Nationwide Check Reduction Work, Launches APG 4.0.

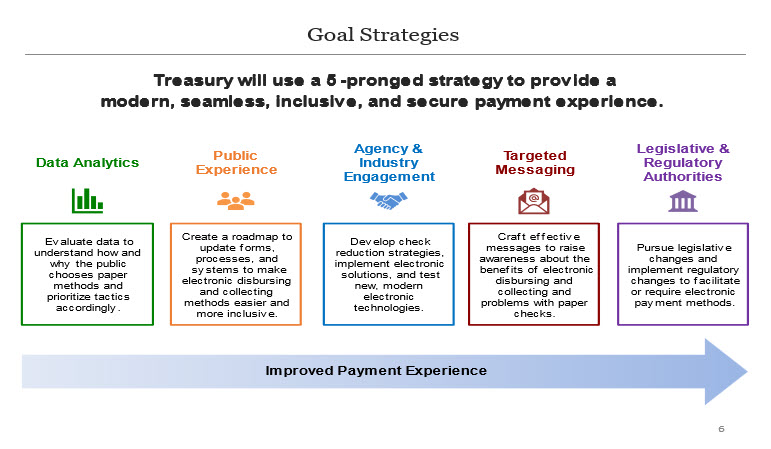

Fiscal Service is making progress to deploy alternative methods of electronic payments, such as debit cards, Same Day ACH, and emerging real-time payment solutions to deliver Americans an improved, inclusive payment experience. The nationwide check-reduction work, now in its fourth iteration, was launched as APG 4.0.

Creating a modern, seamless, and cost-effective federal payment experience for the public is not only a priority of the Treasury, but also a Fiscal Service agency priority goal (APG). The Fiscal Service Innovation, Solutions, and Planning Branch (ISPB), Agency Priority Goal (APG) team responsible for this initiative is meeting that goal by cutting the number of Treasury-disbursed paper checks and increasing electronic payments nationwide.

The team works with the top check producing federal agencies to develop check reduction strategies and promote the benefits of increasing electronic payments in a data-driven way that meets customer needs.

APG 4.0 FY24-FY25

Paper checks place more burden on the public to access their money, increase the potential for payment exceptions, and are not cost-effective for the government or the public. For instance, paper check disbursements are four times more expensive and, historically, 16 times more likely to have an exception (such as reported lost or stolen, returned undeliverable, or altered) compared to electronic disbursements.

When the Department of the Treasury disburses a paper check—rather than using an electronic method—it introduces more steps, more fraud risk, longer wait times, and unnecessary costs for the recipient.

The American public wants emerging electronic payment options that offer payment choice, speed, security, and mobility. To this end, APG Iteration 4.0 welcomes the Internal Revenue Service (IRS) as a Fiscal Service partner. APG Iteration 4.0 will include collaborative work to improve electronic collections of IRS individual and business tax receipts. Through this work, Fiscal Service and IRS aim to grow the public’s trust that making payments to the government electronically is easier, faster, and safer.

What Success Looks Like for APG 4.0

By September 30, 2025, Treasury will:

- Increase the electronic disbursement rate for non-tax Treasury-disbursed payments to 98.4% in FY 2025, compared to 98.2% in FY 2023.

- Increase the electronic disbursement rate for IRS tax refunds to 80.7% in FY 2025, compared to 79.7% in FY 2023.

- Increase the electronic collection rate for IRS individual and business tax receipts to 85.0% in FY 2025, compared to 83.0% in FY 2023.

APG History

APG 1.0 Pilot FY19

In December 2019, Debt Management Services (DMS) signed on with the Administrative Resource Center (ARC) to complete some functions on its behalf. Processing payments is one of those functions. When a DMS debt cannot be identified, or the funds are sent to DMS Management in error, checks are processed to refund individuals/businesses. On occasion, these checks are returned to Treasury. After some research, DMS may reissue those checks if updated information is provided.

Starting June 2021, the Program Accounting Branch in DMS implemented a pilot to explore the capability to refund payments through ACH rather than paper check, where financial institution data from the original payment is available.

APG 2.0 FY20-21

The official APG project at first spanned fiscal year (FY) 2020-2021. In FY 2020, the team’s strategic approach was to work individually with the top check producing federal agencies to help them recognize their role in a paperless government and develop approaches to reaching that goal.

In a Bureau-wide initiative, the APG team worked with the Customer Service Division, Payment Integrity Center of Excellence (PICOE) and the Disbursement Programs Support Branch, Federal Disbursement Services (FDS) data analytics staff to analyze check payment detail data for the agencies: type, volume, dollar, and recipient.

The APG team met the goal in helping agencies to increase electronic payments and cut the number of Treasury-disbursed paper checks to 49 million in FY 2021. As of October 2021, the final check total was 48,944,924. This was 255,076, even fewer checks than the APG target!

APG 3.0 FY22-FY23

The third phase centered on the implementing and executing the bureau’s Financial Management Vision. Besides increasing electronic payments government-wide, Fiscal took on the sole responsibility of creating a modern, seamless, and cost-effective federal payment experience for the public that expanded financial inclusion and improved sustainability (less paper processing).

In APG 3.0, the team set their sights on:

- Cutting the number of checks printed by Fiscal Service from 49 million in FY 2021 compared with 45.7 million in FY 2022 and 44.1 million in FY 2023.

- Increasing the electronic payment rate for Treasury-disbursed payments to 96.56% by the end of FY 2023, compared with 96.18% in FY 2021.

- Increasing the electronic payment rate for IRS individual tax refunds to 81.00% by the end of FY 2023, compared with 80.34% in FY 2021.

For APG 3.0, the APG team promoted PICOE’s account verification service (AVS) tool. The AVS tool confirms an account is valid before a payment is made and helps ensure Fiscal Service is paying the right recipient’s bank account in the right amount at the right time. With PICOE’s help, the APG team progressed towards helping Fiscal Service reach its goal of 99% electronic payments by 2030.

Despite great work, the electronic payment rate and individual tax refund electronic payment rate did not meet FY 2023 targets. The FY 2023 electronic payment rate was 96.45%, missing the target of 96.56%. The FY 2023 tax refund electronic payment rate was 79.7%, missing the goal of 81.0%.